Powered by

100 Million Fund focussed on developing affordable housing units in emerging markets across the US.

General

| Target Raise | $29,600,000 |

| Fund/Managed | Direct |

| Project Stage | Development |

| Term/Lockup | 60 |

| Investor Position | Joint Venture Partner, Limited Partner, Sponsor or GP, Syndication |

| Projected IRR | 25.00% |

| Projected Equity Multiple | 1.90% |

| Strategy | Opportunistic |

Qualification

| Impact Investment? | Community Development, Minority Owned, Social Impact |

| Geographic Focus | Asia-Pacific, Canada, Saint Lucia, United States of America |

| Asset Classes | Student Housing |

| GP capital | 27.00% |

| Tax Incentives | Delaware Trust |

| Domiciled | Delaware |

| Minimum Ticket Size | $5,000,000 |

| Desired Audience | 3rd Party Consultants, Investment Committee, Managing Members |

| Current Participating Investors | 13 |

Economic Drivers

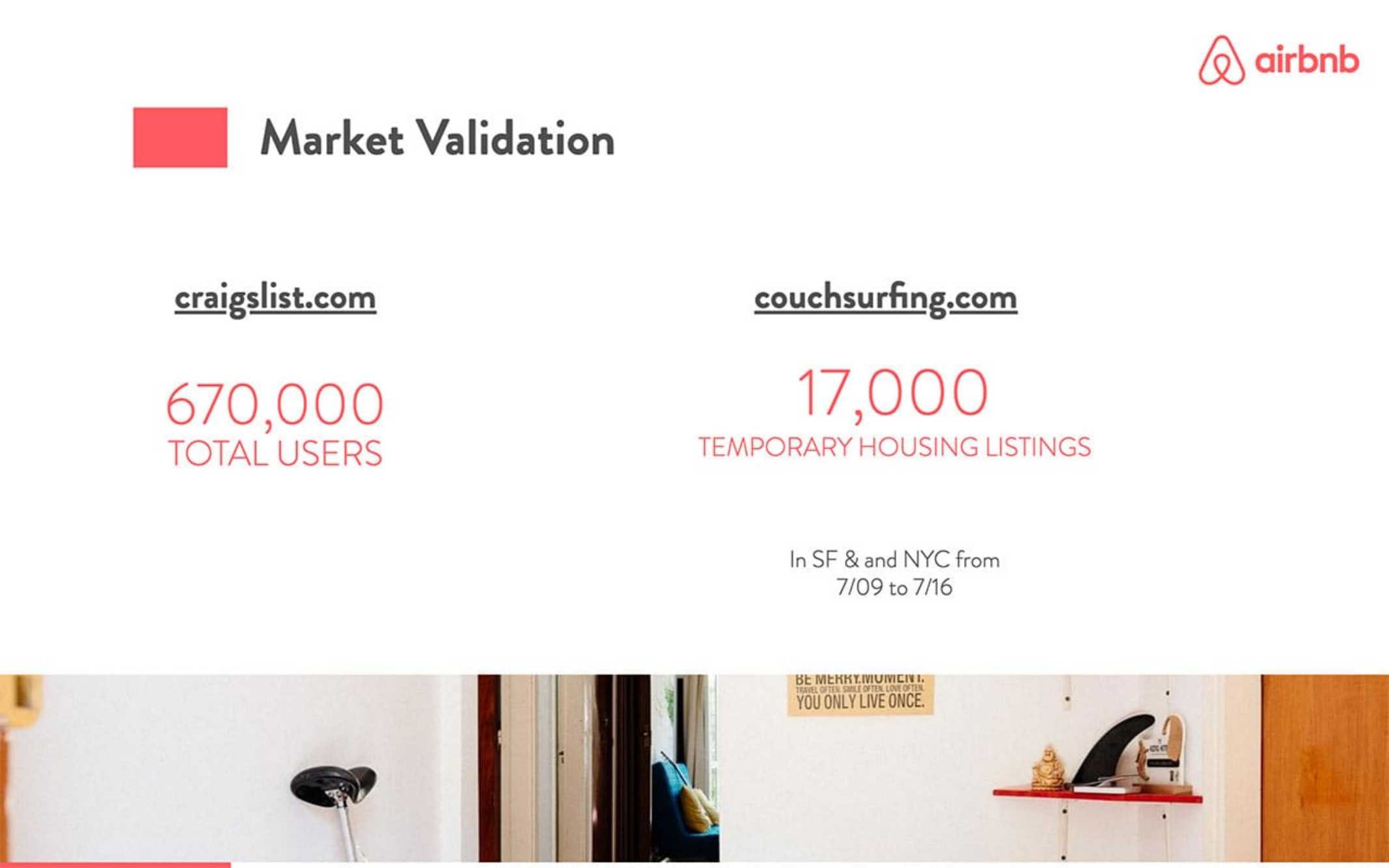

| Economic recession |

| Affordable housing shortage |

| Inflation |

Associated Risks

| New Construction timelines |

| Construction materials supply chain |

Remuneration & Fee Structure

| Asset Management Fee | 2.00% |

| Asset Management Fees Type | Placed |

| Preferred Returns | 8.00% |

| Carried Interest | 20.00% |

| Additional Fees | No |

Time Frame

| Open Date | January 3, 2023 |

| First close Date | February 23, 2023 |

| Expected close Date | December 28, 2023 |

Highlights

| Average IRR Returns | 24% |

| City | Toronto |

| State/Region | ON |

| Country | Canada |

| Total AUM (USD) | $1,253,500,000 |

| Year Established | November 7, 2018 |

| First Time Fund | Yes |

| Avg. GP Contribution | 4% |

General

| Target Investors | Family Offices, Pensions |

| Company Type | Real Estate Firm |

| Address | 171 Bay Street |

| Tax Incentives Available | Yes |

| Impact Investment Strategies | Community Development, Minority Owned, Social Impact |

| Major Source of Capital | Family Offices, Registered Investment Advisors |

| Fiscal Year End | November 7, 2017 |

| Audited | Yes |

| Decision Process | Investment Committee |

| Vertically Integrated | Yes |

| Separately Managed Accounts | No |

| Geographic Reach | USA - Mid West, USA - North, United States of America |

| Seeking Services | Legal, Other |

Notable Investors

| Weldon Kuvalis and Sons |

| Jovanny Bruen Group |

Recent Initiatives

| BCA Community Development Program |

Intermediary Partners

| Parker Moore Inc |

Major Restriction to Consider

| This is a Reg D offering |

| Only U.S. Investors or Institutions for our U.S. registered funds |

Make-up of Assets

| Energy | 2% |

| Infrastructure | 4% |

| Natural Resources | 7% |

| Other | 8% |

| Private Equity | 10% |

| Real Estate | 2% |

| Venture Capital | 2% |

Investment Practices

| Average Deal Size | $94,000,000 |

| Deals Reviewed per Month | 20 |

| Indirect Investment Opportunities | 10% |

| Direct Investment Opportunities | 90% |

Fundamental Risks to Investors

| Rising Interest Rates |

| Economic uncertainty |

Major Acquisition Criteria

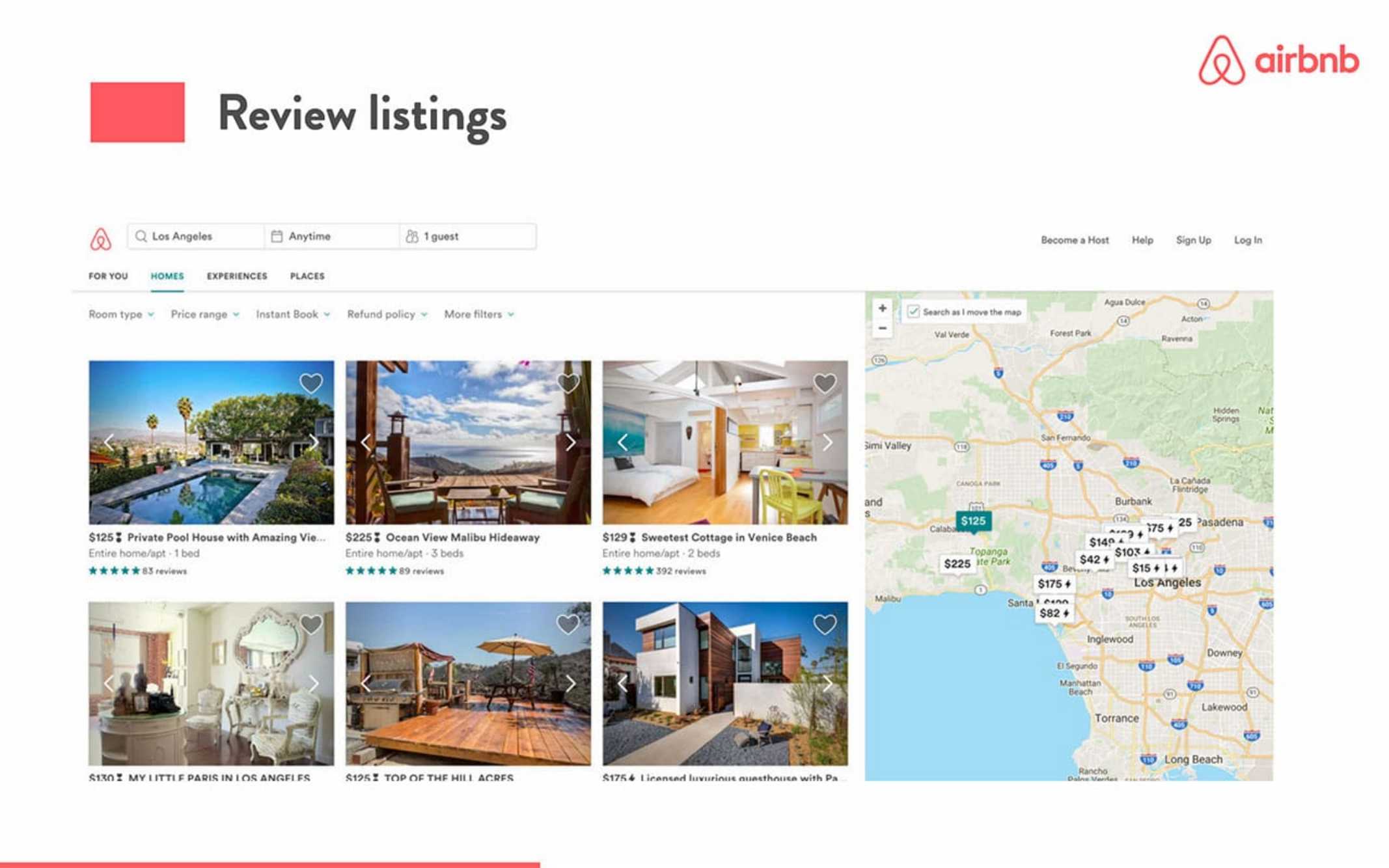

| Located close to commercial hubs |

| Focus is on Class C and D properties in emerging markets |

Notable Recent Investments

| 200 unit Apartment complex in Tulsa, OKlahoma |

| Over 1000 units Built in Nashville since 2018 |

Historical Performance

| Investor Retention Rate | 100% |

| New Investors in the Last 12 Months | 15 |

| Average Equity Multiple | 6.70 |

| Average IRR Returns | 24% |

| Largest Investment Received | $15,000,000 |

We developed an affordable housing community in 2020 that yielded a 25% IRR and a 2.1x equity return.

We have never lost money on any single asset

Miscellaneous

Investment performance. We are extremely disciplined investors, which we believe will lead to consistent returns even at the expense of immediate returns. High inflation rates, soon to be reduced, will shirt the way homebuyers and home renters behave. Affordable housing supply in our target cities. COVID and the recession has drastically increased the cost of living while the income levels have stayed the same or come down. There is now a drastic need for affordable housing, which has not been met. In a climate of economic boom and a condition where there are more buyers than renters, we would struggle to find tenants. However, this scenario is almost impossible and certainly not sustainable.Financials

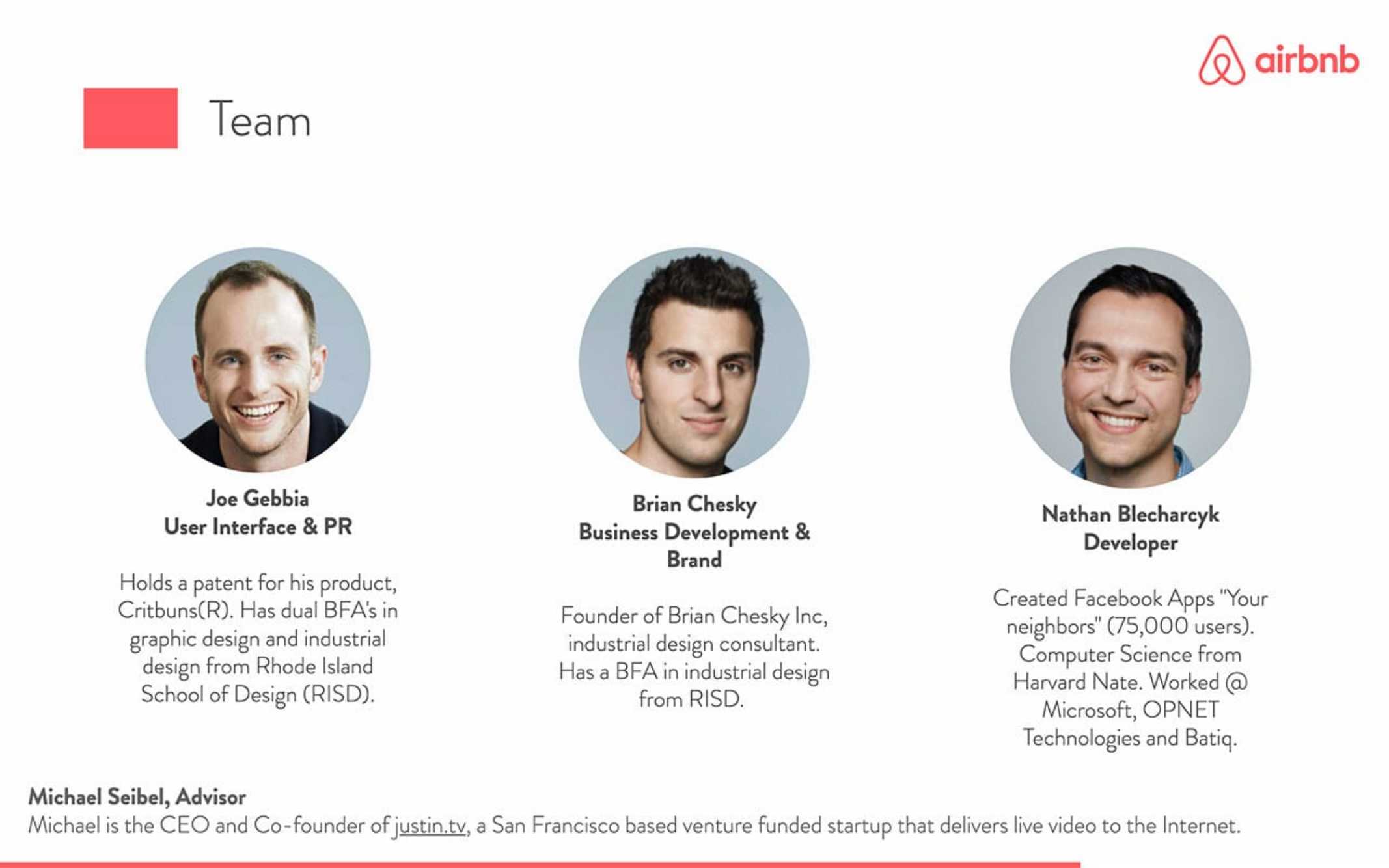

Team

Legal

Other

No files

Traction

Marketing/Promotion

Investor Interest

Other

No files

Miscellaneous

Miscellaneous

No files

General

IRIS Summary

Version History